In a competitive environment, often a “checklist” battle dominates. This is especially true if you are competing with an enterprise incumbent. There are many ways to compete with a company that has more resources, existing customers, and access to broad communications channels. You can be systematic in product choices and communication approaches and increase the overall competitive approach.

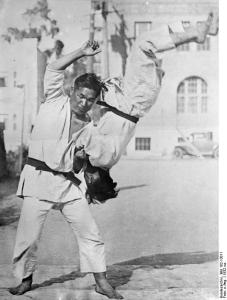

You can think of these as the Jiu-Jitsu of the Stack Fallacy — using the reasons competitors can fail as your strengths:

- Avoid a “tie is a win”

- Land between offerings or orgs

- Know about strategy tax

- Build out depth

- Create a job-defining solution

This post is mostly from an enterprise competitive perspective, but the consumer and hardware dynamics are very much the same. While some of this might seem a bit cynical, that is only the case if you think about one side of this battle being better than another — in practice this is much more about a culture, context, and operational model than a value judgment.

Avoid a “tie is a win”

The first reaction of an incumbent (after ignoring then insulting the competition) is to build out some response, almost always piggy-backed on an existing product in an effort to score a “tie” with reviews and product experts (in the enterprise this means places like Gartner). The favorite tool is the “partner” or “services” approach, followed by a quick and dirty integration or add-in. Almost never do you see first party engineering work to compete with you, at least not for 12–24 months following “first sighting”.

Their basic idea is to clear the customer objection to missing some feature and then “get back to work”. In enterprise incumbent-speak, “a tie is a win”.

The best way to compete with this behavior is to go head to head with the idea that a checkbox or add-in does away with the need for your service and worse such an implementation approach will almost always be insufficient over time and hamstrung by the need for integration.

Don’t worry about your competitor pointing out the high cost of your solution or the burden of something new being brought into the enterprise. Both of those will become your strengths over time as we will see.

Land between offerings or orgs

The incumbent’s org chart is almost always the strongest ally of a new competitor. The first step is to understand not only where your competitor is building out a response, but the other product groups that are studying your product and getting “worried”. Keep in mind that big companies have a lot of people that can analyze and create worry about potentially competitive products.

You can bet, for example, that if you have any sort of messaging, data storage, data analysis, API, or visualization and compete with the likes of Oracle, Salesforce, Tableau, or other big company that several groups are going to start thinking about how to incorporate your product in their competitive dialog.

You can almost declare success when you hear from your customers that your product has come up in multiple briefings from a single company. Perhaps the biggest loss in a large company is when a Rep loses a deal to a competitor and news of that travels very fast and drives tactical solutions equally fast — tactical because they are often not coordinated across organizations.

When you find yourself in this position, two things work in your favor. First, there’s a good chance you will soon find yourself competing with two “tie is a win” solutions , one from each org— white papers talking about partners who can “fill in the gaps” or add-ins that “do everything you need”, for example. No P&L or organization wants to lose a deal over a competitor.

Second, you will have time to continue to build out depth because the organizations will begin the process of a coordinated response. This just takes a long time.

The best thing that can happen at this point is if you have a product that competes with two larger companies. At that situation you can bet that you are the thing those companies care the least about and what they care the most about is each other. You might find yourself effectively landing between many organizations then and that spot in the middle is your whitespace for product design and development — go for it!

Know about strategy tax

Once an organization grows and becomes successful, one of the key things it needs to do is define a reason for the whole to be greater than the sum of the parts. The standard way incumbents do this is to have some sort of connection, go-to-market, feature, or common thread that runs through all the offerings. This defines the company strategy and the reason why a given product or service is better when it comes from a particular company (and also the reasoning behind a company being in multiple businesses).

In practice, the internal view of these efforts quickly becomes known as astrategy tax. From a competitive perspective these efforts are like gifts in that they make it clear how to compete. For example, your product might have integrated photos but your competitor needs to point customers to another app to deal with photos. Your product might be supported by channel partners but your competitor will only sell direct (or vice versa). This can go to an API level, particularly if you compete with a platform provider who is strategically wedded to a specific platform API.

A classic example for me was the Sony Memory Stick. If you were making any device that used removable storage then you were clearly going to use CF or SD. But there was Sony, marching forcefully onward with Memory Stick. It was superior. It had encryption. It had higher capacity (in theory). At one point after a trade show I left thinking they are going to add Memory Sticks to televisions and phones, and sure enough they did. What an awesome opening if you needed to compete with a Sony product.

A strategy tax can be like a boat anchor for a competitor. Even when a competitor tries to break out of the format, it will likely be half-hearted. Any time you can use that constraint to your advantage you’ll have a unique opportunity.

Build out depth

The enemy of “tie is a win” is product depth. Nothing frustrates an incumbent more than an increasingly deep feature set. Your job is to find the right place to add depth and to push the incumbent beyond what can be done by bolting capabilities into an existing product via add-ins, partners, or third parties.

Depth is your strength because your competitor is focused a checkbox or a tie, figuring out the internal organization dynamics of a response, or strategizing how to break from the corporate strategy. While you might be out-resourced you are also maniacally focused on delivering on a company-defining scenario or approach.

The best approach to building out depth is to remain focused on the core scenario you brought to market in the first place. For example, if you are doing data visualization then you want to have the richest and most varied visualizations. If you have an API then your API should expose more capabilities and your use of the API should show off more opportunities for developers.

There’s a tendency to believe that you need to build out a solution that is broad and to do that early on. The challenge here is that this takes you into the incumbent’s turf where you need to build not only your product but the existing product as well. So early on, push the depth of your service and become extremely good at that — so good that your competitor simply can’t keep up by using superficial means to compete. This example from Slackcrossed my feed today and shows the depth one can go to when there is a clear focus on doing what you do better than anyone else.

Your goal is to expand the checkbox and to move your one line of the checkbox to several lines. This is how you change the “tie is a win” dynamic — with depth and ultimately defining a whole category, rather than one item.

Create a job-defining solution

When building a new product and company, one of the most significant signs of success is when your product becomes so important it is literally someone’s job. Once you become a job then you are in an incredible feedback loop that makes your product better; you have an opportunity to land and expand to other parts of a big company; and you have an advocate who has bet a career on your product.

New products have a magic opportunity to become job-defining. That’s because they enter a customer to solve a specific problem and if that gets solved then you have an advocate but also a hero within the company. Pretty soon everyone is asking that person how they get their job done so much better or more efficiently and your product spreads.

The amazing thing about this dynamic is that it often goes unnoticed because rarely are you replacing entirely something that is already in use, but simply augmenting the tools already in place. In other words, the incumbent simply goes about their business thinking that your product just complements their existing business.

This obviously sounds like a big leap to accomplish, but it speaks to the product management decisions and how you view both the product and customer. With enterprise products it is almost always a two step process. First you solve the specific user’s problem and then you solve the problems the IT team has in using the product as part of a business process (i.e. authentication, encryption, mobile, management).

This works particularly well because your incumbent’s product has already achieved this milestone, and it is their product that (a) is not working and (b) is almost certainly some other function’s job software. It is another way of landing in the whitespace of the organization. Your competitor’s job is not looking for more to do, especially not someone else’s job, so you have some clear road ahead.

In

In